Hold on, eager investors, I’m not going to mislead you. Not every stock is going to rise during a limited nuclear war. There will, however, be a few nuggets here and there. But first, let’s decide on a definition for a limited nuclear war. For our purposes, it shall be one modest nuclear missile lobbed at one of our major cities by some disgruntled country, DC, that is really, really peeved at us. I won’t name names, DCs, that would be impolite, but you know who you are. Don’t make me come back there.

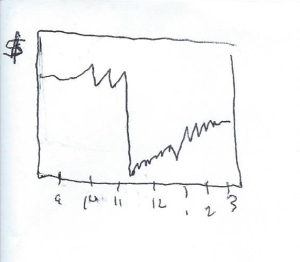

What would be the general effect of that peeved country nuking one of our cities? Sad to say, it’s almost a certainty the market would react negatively to such news. Why? The market hates uncertainty, even more than you hated going to the dentist as a kid. Just look how the housing/lending crisis, a few hundred billion dollars lost here and there and WHAMO!, the stock market plunges 50%

But even more uncertainty would result from even so pro forma a strike as one nuclear missile. Who know, that DC might up and launch another ten or twenty missiles at our cities. If that isn’t uncertainty, then what is? So, I feel safe in saying that even one obliterated city would drive the stock market down by more than 50%. And that goes for all major indices, not just the DJIA.

Such pessimism by the market is only natural. Who hasn’t taken an occasional view whether from a marital spat, an unkind word from a colleague, or an undeserved parking ticket. But life is never all bad. All clouds have a silver lining, even a smallish nuclear war.

Suppose some bad country’s nuclear missile wiped out Chicago, forever wiping out the Cub’s chances to win the World Series. Chicago is littered with insurance companies. They would be vaporized. Less competition for out-of-Chicago insurance companies means more profits for them. More profits mean higher share prices.

There, I see the smile coming back to your face. Just make sure pick an insurance company with limited exposure to the windy city. Chicago is also a major rail and air hub. Sell all railroad and airline companies going through there in favor of ones with hubs in St. Louis or New Orleans. Furthermore, the future for hospital stocks would look particularly bright with many people likely to need multiple, expensive treats.

See? A modest nuclear strike would present many opportunities for the savvy investor. Be one.

– Paul De Lancey, Dr. Economics

Check out my latest novel, the Christmas thriller, Beneficial Murders. My books are available in paperpack or Kindle on amazon.com,

or on my website-where you can get a signed copy at: www.lordsoffun.com

Well you have me won over Chef but as long as it’s only a modest nuclear strike.

BOOM! and then bust?

Let’s hope it’s not a cycle.